9 Easy Facts About Tidepoint Construction Group Described

Wiki Article

The Best Guide To Tidepoint Construction Group

There are lots of things that might benefit from a fresh layer, from cabinets to stairwells to an accent wallresearch which colors function best where. For instance, light colors make tiny spaces look larger, so cheer up washrooms as well as smaller sized areas with those. Kitchen remodeling company near me. Make sure to speak with an expert on which kind of paint to use before purchasing, as some are much less susceptible to mold as well as mold if made use of in a restroom. https://www.gaiaonline.com/profiles/tidepointc0n/46364895/.

Buy ADA-compliant devices like commode paper holders and towel bars that not only include to the appearance of your house yet the safety and security of it as well. Additionally, things like motion-activated outside lights are not only energy-efficient but can hinder burglars from entering your home. While many presume remodeling is only useful from an aesthetic perspective, there are a handful of other benefits that occur from upkeep, remodels and constant repair work specifically why there are a lot of programs dedicated to investing and loaning money toward it.

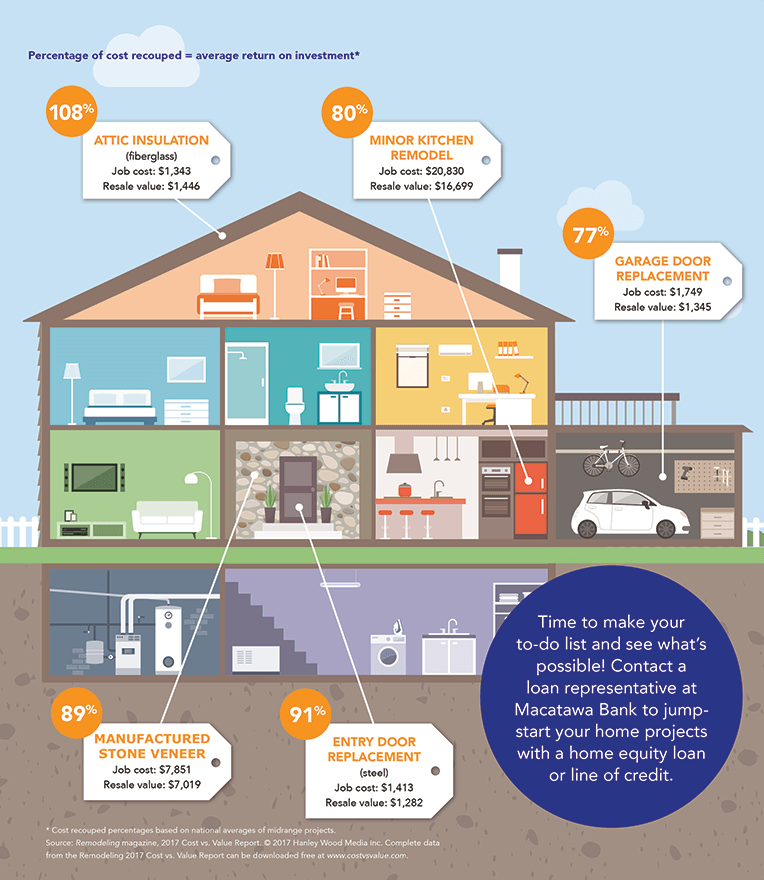

Despite the fact that you may be forking up cash initially, spending in premium materials upfront will enable much less pricey and also unwanted repair work along the method. Similar to the above factor, purchasing upgrades can boost the resale value of your home should you intend to market in the future.

A fresh coat of paint or a newly crafted home fitness center can cultivate an uncluttered home and mind.

A Biased View of Tidepoint Construction Group

Are home repair work or upgrades tax obligation insurance deductible? If so, what residence renovations are tax deductible? In various other words, home renovation tax obligation credit histories are a dollar-for-dollar reduction of tax obligations as well as reductions are minimized by how much money you make per year.

It ultimately boils down to what kind of remodel you're finishing as well as whether it's identified as a repair or a renovation. is any type of alteration that brings back a residence to its original state and/or worth, according to the IRS. Residence repair services are not tax obligation deductible, other than when it comes to office and also rental residential properties that you own even more to come on that later in this overview.

, a new septic system or built-in devices. Residence improvements can be tax deductions, however some are just insurance deductible in the year the home is sold.

3 Simple Techniques For Tidepoint Construction Group

If you're unclear whether a repair work or enhancement is tax deductible, contact a local tax obligation accounting professional who can address your questions regarding filing. Please note residence renovation fundings aren't tax deductible since you can not subtract rate of interest from them. If this puts on you, stop reading below. Rather, concentrate on where you can obtain the most go to my site effective return when offering your home with these tips.

The solar credit history will continue to be up until 2019, and afterwards it will certainly be lowered each year via 2021." Placing solar power systems on new or existing residences can still result in a 30% credit history of the complete cost of installment. This credit history is not restricted to your key residence as well as is also readily available for freshly constructed homes.

Tax Reduction Same Year Tax-deductible home improvements associated with treatment are usually difficult to find by. If you intend on aging in area, these deductions may relate to you in full. You can include costs for clinical equipment installed in your home if its main purpose is to offer look after you, your spouse or a dependent.

Repair work made directly to your workplace Improvements made straight to your office space Services made to other parts of the residence (partly deductible) Some improvements made to various other components of the house (partially deductible) Fixings that straight impact your business room can be deducted in full (e. g., mending a damaged window in your office).

The Definitive Guide to Tidepoint Construction Group

If your office occupies 20% of your house, 20% of the improvement price is tax-deductible. Home remodeling company near me.

8% Rating severe resale worth as well as some great R&R time by including a timber deck to your backyard. Simply make sure to include barriers, pressure-treat the timber, as well as seal it to protect it from the components.

If it's also stylish or too custom-fit, it will likely estrange some purchasers when you're prepared to sell.

Report this wiki page